Why Solana Is a Magnet—for Great Games and Fast Scams

Solana’s low fees and speed are tailor-made for on-chain game loops, micro-transactions, and NFT inventories. But that same speed plus one-click token launchpads has also invited a scam Solana Blockchain Games like noisy side-show: drainer campaigns, pop-up phishing, and “mint today, vanish tomorrow” tokens. Since late 2023, researchers have tracked Solana-specific drainer kits (e.g., CLINKSINK) siphoning funds after users unknowingly approve malicious transactions—often through slick, fake wallet prompts.

In parallel, memecoin frenzies periodically flood Solana with opportunistic tokens—including “tribute coins” spun up around breaking news or celebrity deaths—some of which yank liquidity minutes after launch. That volatility can splash onto gaming tokens and in-game NFTs, even when devs are legit; if you’re unsure, review liquidity locks and rug-pull checks before buying..

Are Blockchain Games Safe?

Short answer: They can be—but only when you slow down and verify. Regulators and consumer-protection groups warn that crypto investments attract impersonators, fake platform operators, and high-pressure “guaranteed returns.” Those patterns show up in gaming, too: pre-sale hype, fake audits, and wallet-draining pop-ups. Learn the tells—and don’t bypass basic checks.

The Scam Playbook (Solana Edition)

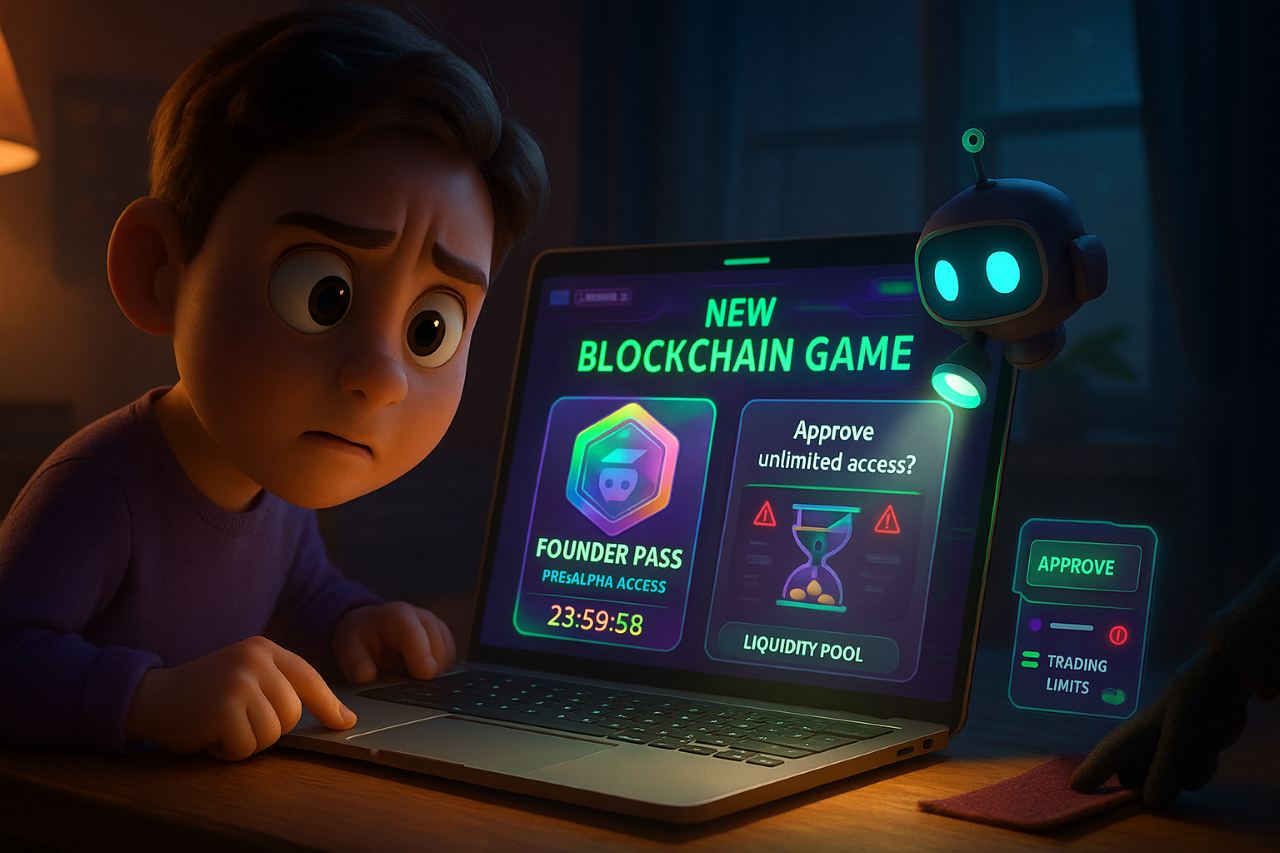

1) Fake Pre-Alphas & “Founder Pass” Hype

Landing pages tout cinematic trailers but no playable build. “Founder passes” or “pre-alpha access keys” are sold, then the team ghosts or pivots to a different token. Liquidity in the associated pool is barely locked—or not at all—so exits are quick. (Use independent rug-check tools before touching anything.)

2) Liquidity Rugs on “Game Tokens”

Tokens launch, the chart prints a neat hockey stick, and early holders can’t sell once the deployer pulls liquidity or toggles trading limits. This isn’t theoretical—Solana DeFi has documented, large-scale rug-pull patterns; gaming tokens aren’t magically immune.

3) Drainer/Phishing via Wallet Prompts

Users see a Phantom-style pop-up—sometimes injected by ads or a compromised site—and sign a transaction that looks benign. The drainer then empties tokens or NFTs. Never approve a request you don’t understand. Re-open the site from a fresh tab and verify the domain.

4) “News-Jack” & Celebrity Tokens

Grifters spin up tribute tokens tied to breaking events, then yank liquidity when attention peaks. If your “game token” marketing leans on a headline instead of gameplay, step back.

5) Impersonation & Recovery Scams

Scammers pose as regulators or “platform support,” claiming to unfreeze your game NFT or “recover” lost funds—for a fee. That follow-up scam solana blockchain games is sadly common.

What is an example of a gaming scam?

A typical pattern: a “playable demo next week” NFT pass drops on a slick site; the team tweets non-stop; liquidity is thin; the token moons; trading limits quietly change; the main wallet drains the pool. Holders are left with screenshots and a Discord that goes dark. (If this sounds familiar, it’s because it mirrors the broader rug-pull patterns seen across Solana tokens.)

The 30-Second Safety Audit (Bookmark This)

- Team reality check: Do founders use real names that map to LinkedIn/GitHub histories? Any shipped games?

- Code + audit: Public repo? Third-party audit (not a cut-and-paste PDF)?

- Token mechanics: Mint/burn rights? Trading limits? Ownership renounced?

- Liquidity: Is LP locked with a verifiable lockup? How long?

- On-chain scan: Run a live rug check (ownership concentration, LP status, suspicious functions).

- Wallet prompts: If Phantom (or any wallet) asks you to approve a mystery action, stop. Re-enter the site via a fresh URL; compare the domain letter-by-letter.

How Can You Tell if Someone Is a Crypto Scammer?

Look for the trifecta that consumer-protection agencies repeat: pretend, problem, pressure.

- Pretend: “I’m with support/regulators/influencers.”

- Problem: “Your account is frozen / urgent security issue.”

- Pressure: “Pay now—crypto or gift cards only.”

If you see those beats, it’s theater—hang up, close the tab, and verify through official channels.

How to Identify a Fake Crypto Platform (Before It Identifies Your Keys)

- Domain hygiene: Typosquats, hyphens, nonstandard TLDs, or recently registered domains signal risk.

- No verifiable company footprint: No real-world entity, no filings, no staff with history.

- Impossible claims: “Guaranteed daily ROI,” “risk-free staking.”

- Impersonation: Fraudsters even pose as regulators (e.g., UK’s FCA) to add fake legitimacy—always verify using official phone lines or contact forms.

Due Diligence, But Deeper (When You’re Serious About a Project)

Token & Liquidity

Check LP lock duration, mint authority, and anti-whale/blacklist functions. Excessive dev allocation or unlocked team wallets = exit risk. Rug-pull datasets on Solana’s DeFi side show how often liquidity games are the tell.

Repos, Audits & Update Cadence

A living repo (commits/issues), reproducible builds, and an audit from a known shop beat glossy PDFs. No code + “audit badge” linked to a JPEG? Hard pass.

Gameplay Reality

Playable demo > trailer. If “gameplay” is stock footage and the whitepaper reads like a token sale more than a design doc, you’re not early—you’re bait.

Wallet Safety

Install updates from official links only. Set spending limits where possible. Treat every signature like a wire transfer. Drainers thrive on blind clicks.

Tools & Habits That Actually Help

- Rug-checkers for Solana tokens/NFTs: SolanaTracker’s Rugcheck (LP, holders, contract flags).

- Skeptic’s news filter: Be extra wary when tokens appear minutes after breaking news—common rug timing.

- Wallet pop-up skepticism: Phantom-lookalike prompts are a known phishing vector.

- Consumer-grade guardrails: Keep the FTC’s punch-list handy for spotting investment scams (guarantees, urgency, payment method coercion).

FAQ

Are blockchain games safe?

They can be, but only when you verify teams, code, liquidity, and wallet prompts. Use live rug-checkers, demand a playable build, and never sign blind transactions.

How can you tell if someone is a crypto scammer?

Impersonation + urgency + crypto-only payment are classic tells. Verify claims through official channels; do not continue conversations inside DMs or pop-up chats.

How to identify a fake crypto platform?

Audit the domain, company records, and compliance statements. “Guaranteed returns” or “act now” language is a no-go; regulators warn about this pattern.

What is an example of the Scam Solana Blockchain Games?

A “founder pass” mint with no playable build, thin liquidity, and an anonymous team that later pulls the pool and disappears. It mirrors well-documented rug-pull behaviors on Solana.

tikiokviral

Casino Telegram bot

Ton coin

Ton wallet

tikiokviral

Jetstar Australia

LINK IN BIO

LINK IN BIO

Crypto

telegram bot

BTC

[…] With its emphasis on speed, security, and convenience, the TON wallet app has become a powerful all-in-one solution for both casual gamers and serious traders exploring the expanding NFT and blockchain gaming ecosystem. […]

[…] article dives deep into Solana coin fundamentals, Ethereum’s strong ecosystem, and how both cryptos fit into the evolving NFT landscape. By the […]

[…] Scammers thrive where money moves fast. Understanding scams helps you steer clear of traps. […]

[…] How do I avoid scams in student […]

[…] scams and fake […]

[…] the exact domain + “scam blockchain” or “drainer” and skim recent […]

[…] Scammers play on urgency, novelty, and authority. Beat them with a calm routine. […]

[…] Paste the domain and project name into Reddit and X with “ Solana scam.” […]

[…] do I avoid blockchain scams when buying […]

[…] the username carefully, search for Solana scam reports, and never click links from random DMs. When in doubt, find the official link from a […]